NFTs Gon' Give it to Ya - NFTs in the Music Industry

Music NFTs liberate artists, create new revenue streams, and enable anyone to earn as a music curator.

This post is divided into three parts, each of which can be read independently:

Part I: How the music industry operates today

Part II: Six ways NFTs are disrupting the industry and unlocking new revenue streams

Part III: A deep dive into VC investment trends in blockchain music companies

Summary

Music NFTs: Reshaping the Music Industry’s Power Dynamics

For decades, major record labels and digital distribution platforms have dominated the music industry, controlling the majority of revenues and streaming relationships. However, power is shifting—artists now have more opportunities than ever to monetize their work independently.

The rise of digital distribution platforms and lower production costs has led to an explosion of new music. Yet, despite this accessibility, artists still only receive 13%-20% of royalties, with the majority going to labels and platforms. Frustration with contracts and royalty splits is at an all-time high.

A New Economic Model for Artists

Music NFTs offer artists a direct path to ownership, control, and financial independence. Unlike traditional royalty structures:

Artists can earn up to 100% of royalties

NFT sales provide instant liquidity. Instead of waiting for record label payouts, artists can receive funds upfront

Decentralized platforms enable instant payments, removing intermediaries that delay disbursements

Fans can invest in songs and earn future royalties. This new model enables early supporters to participate in an artist’s success

Beyond royalties, music NFTs foster stronger artist-fan relationships. Artists are building exclusive communities of super fans, rewarding them with exclusive content, experiences, and access.

In its first year of significance, music NFTs generated $86M in primary sales. Investors are taking note—VCs poured $219M into blockchain music companies in 2021 and 2022.

Part I - The State of the Music Industry

Record Labels and Distributors

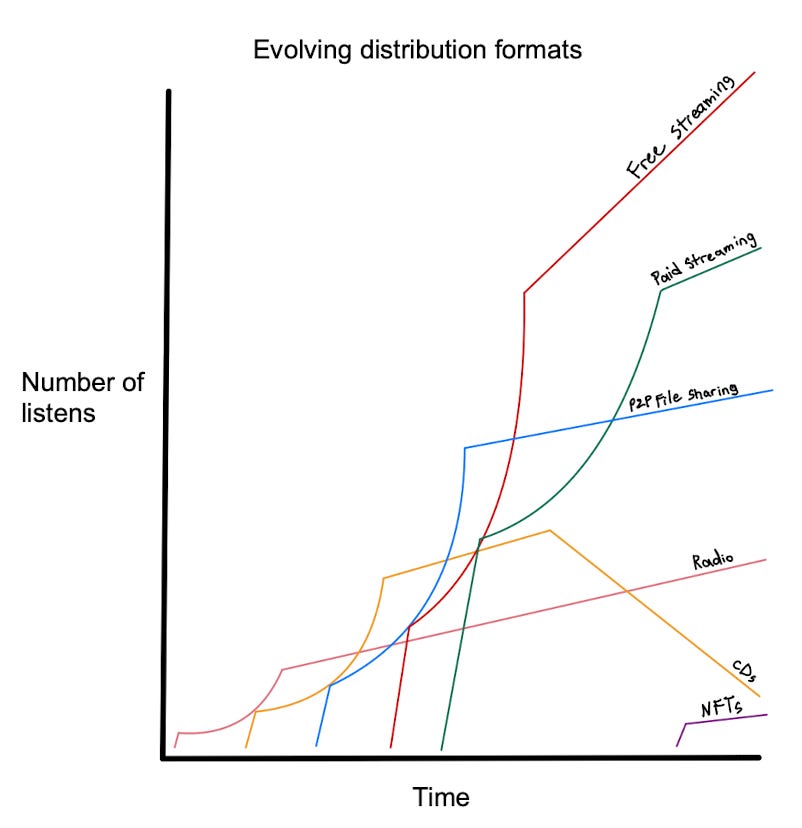

Technology is crucial in creating and distributing music. Arguably, music distribution platforms and formats have the most impact on industry revenues and dynamics. Over time, music distribution advancements have allowed listeners to access more music in more places. Distribution formats like NFTs promise to advance the music industry further in many ways.

Before diving into how NFTs are changing the music industry, let’s first understand the current state of the music industry.

Record labels have resurged in the last eight years, thanks to digital distribution platforms.

Record labels grew revenues by 18% to $25.9B in 2021, with 75% coming from digital distribution platforms.

The last time revenues were north of $20B for record labels was in 2001. In fact, from 2001 to 2014, revenues declined by 60%, bottoming at $14B because free P2P file sharing and mp3 players destroyed CD revenues. The record label industry was on life support until digital distribution platforms came along and amassed over 523M monthly active listeners for record labels and artists to access. Digital distribution platforms and other internet-based platforms like TikTok, providing new digital distribution channels, are pushing the music industry revenues even further. Digital distribution platforms have also given rise to independent record labels. Independent Record labels increased market share by working directly with digital distribution platforms while also distributing through major record labels.

Digital distribution platforms have taken over the music industry and are potential threats to record labels since they can sign artists or allow artists to upload music directly.

Once a threat, the internet has become the greatest distribution machine for the music industry. Major record labels realized this and inked massive deals with digital distribution platforms early on. For example, the big three record labels, which own 68% of the music recording industry, have acquired three to six percent equity in Spotify. Spotify also paid out $7B in royalties to major record labels in 2021, almost twice the 2017 numbers. Spotify alone earned $11.4B in revenues in 2021 and is projecting to reach $100B in revenues in ten years. Spotify expects to grow margins to 40% and operating margins to 20% in the same period. For a detailed breakdown of digital distribution platforms, check this out.

For now, record labels and digital distribution platforms like Spotify have a symbiotic relationship. However, as Spotify grows, it wouldn’t be a shock if it starts to sign artists directly or let artists upload without a label or distributor. Spotify tried in 2019 but chose to shut it down because of distributor backlash. Other digital distribution platforms like Apple, SoundCloud, and YouTube allow artists to upload their music independently.

The battle between digital distribution platforms is destined to heat up as they compete to attract artists and listeners. For example, SoundCloud is testing a more artist-friendly revenue model to pay artists directly for streams to attract artists. It recently signed a deal with Warner Music Group to onboard all its artists.

Artists

The distribution cost for independent artists is lower than ever via digital distribution platforms, and music creation has also become inexpensive.

As a result, new artists, songs, and genres are emerging so fast record labels aren’t able to keep up. They currently rely on independent record labels to source new artists and in turn provide distribution for them. For example, Billboard’s Top 10 (dominated by major record labels) lags Spotify's Top 10 by about three months and remains thirteen weeks longer. Viral songs have significant plays on the radio even nine months later.

In addition, major record labels have lost listeners' interest; the Grammy’s, the showcase of new music amongst major record labels, lost 50% of its viewership Y/Y in 2021.

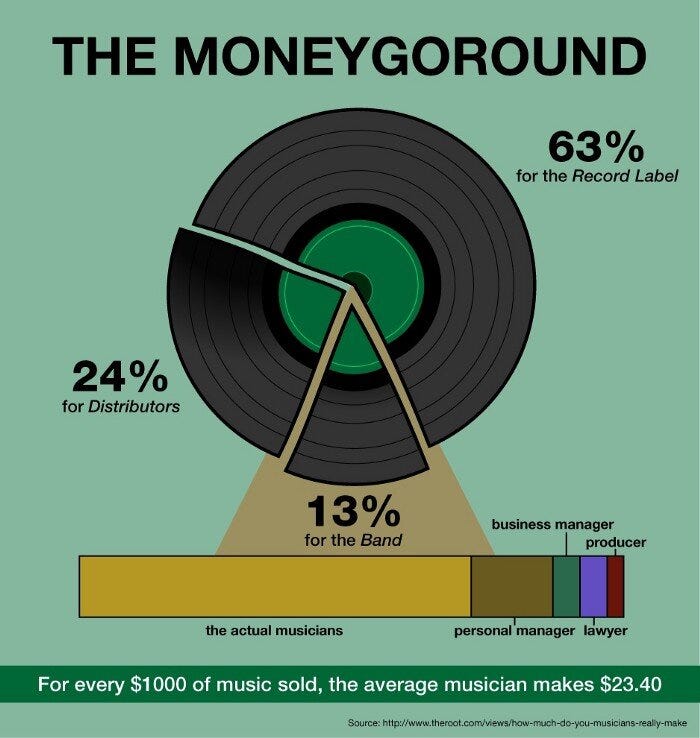

Artists earn a small portion of their music's overall revenues, as the majority goes to record labels and distributors.

Music label and artist revenues are generated mainly through royalties. Generally, new artists earn 13%-16%, mid-level artists earn 15%-18%, and superstars earn 18-20%. A 50% cut is rare and only possible with independent record labels. Here’s a sample breakdown of royalty splits for new artists:

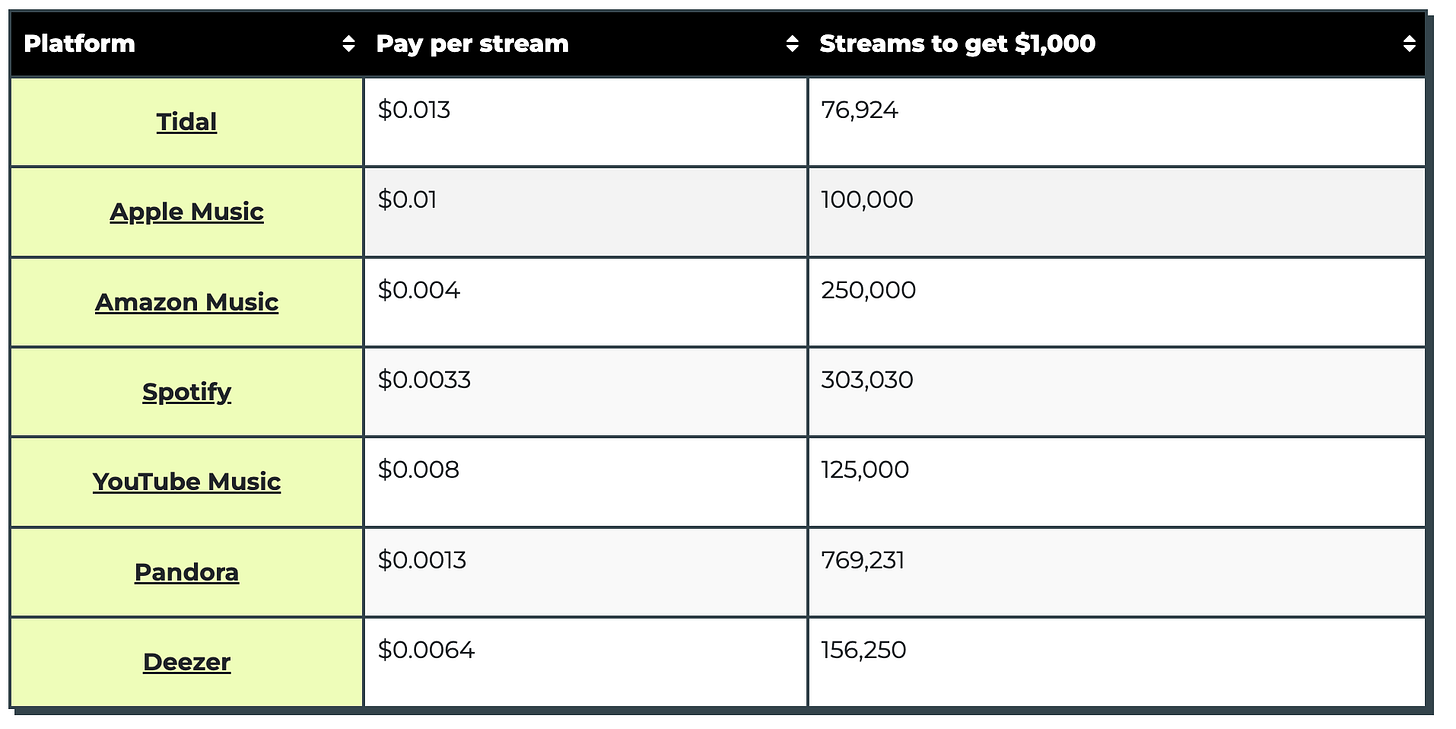

Depending on the platform, artists are making different amounts per stream:

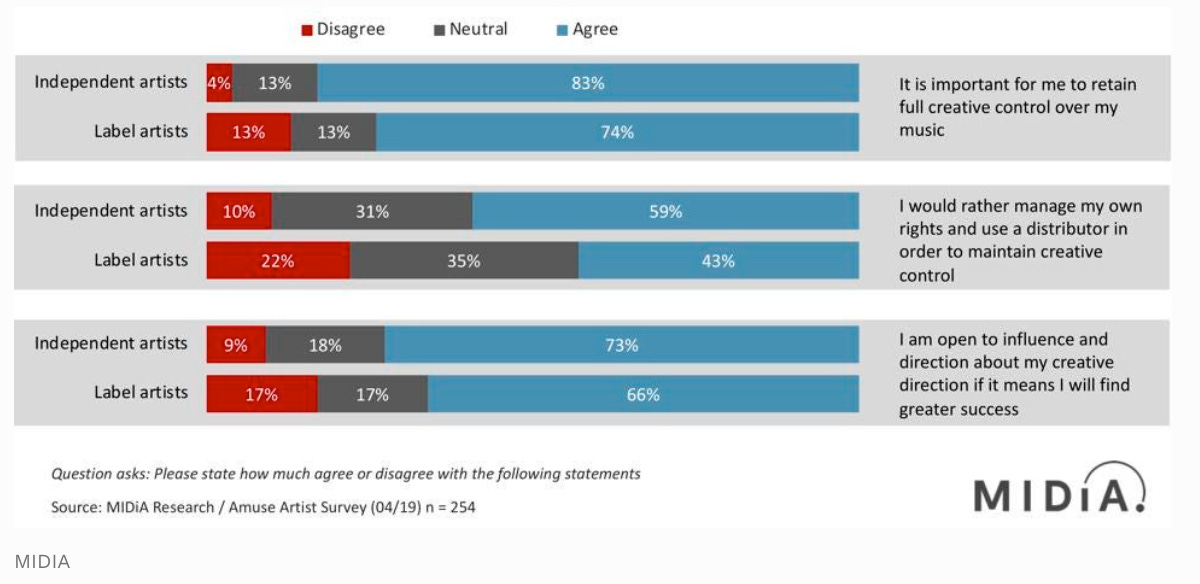

Artists want a more significant cut of royalties, especially as they rise to superstar status.

One of the most talked about developments in the music industry in the past few years has been the bad blood between top-tier artists and major record labels. Kanye West, Taylor Swift, and Frank Ocean, to name a few, have famously severed ties with record labels. One thing is sure; artists want more independence and a more significant cut of royalties.

Record labels have introduced 360 deals with new artists, which allow additional access to artist revenue streams such as merchandising and touring.

Record labels have responded by being even more overbearing with 360 deals, which are seen as predatory for new artists and make new artists essentially employees of record labels. Perhaps this is a last-ditch effort to deter future breakout stars from easily severing ties and signals that record labels need to identify new revenue streams to continue growing as digital distribution platforms to expand.

The rise of independent artists continues to increase.

Independence allows artists creative freedom and ownership of royalties and emphasizes interacting more closely with fans through the web and live events. NFTs enable artists to take their independence and fan interactions to the next level.

Part II - The Music Industry Needs NFTs

I outlined the many factors shifting power from record labels to distributors to artists in Part I. In Part II, I’ll discuss how blockchain tech, NFTs in particular, are disrupting the music industry. WaterandMusic DAO calculated that artists generated $86M in primary music NFT sales in 2021, the introductory year of music NFTs.

Namely, blockchain music companies like Royal.io and Audius are leading examples of how NFTs are disrupting the music industry.

On Royal.io, artists split royalties earned from web2 digital distribution platforms with anyone who wants to invest in the artist’s music NFTs. This is great for artists who don’t want to wait quarters or years to receive their royalty payments and want cash upfront. In the long term, it will help artists bypass record labels and own more of their royalties since artists will have more funding sources to choose from. Investors receive perpetual royalties from top artists, or they can bet on new upcoming artists. Record labels can also invest smaller amounts directly in music NFTs to earn a piece of artist royalties rather than loan relatively large amounts to newly signed artists. Web3 record labels have emerged doing just this. Check out the latest post on web3 record labels from CoopahTroopa here.

On Audius, artists and fans own the digital distribution platform and master files. Fans directly support artists and playlist curators. Artists upload music independently on Audius and are paid instantly when their music is played. Theoretically, decentralizing ownership of the digital distribution platform through a native token allows all parties to be involved in the governance and future of the platform. It realigns incentives and mitigates any conflicts of interests record labels, or digital distribution platforms have to promote their artists over others.

Royal.io and Audius are arguably the leading examples in the space. Overall, music NFTs are empowering artists to own more of their art, allowing fans to invest in and get paid to curate music, creating new fan experiences, improving rights management and royalties payments, disrupting label and distributor business models, introducing new competitive opportunities, and growing revenue streams for all parties.

Music NFTs disrupt the music industry in the following ways:

Fans, Community, Investors, and Web3 Record Labels

One of the most popular topics within the web3 music community is music NFTs. Fans of an artist show their support by purchasing limited NFTs from the artist and hold the NFTs as a collectible that can be sold in an open market. The NFT can also be leveraged for special access to exclusive content or in-person interactions with the artist. NFTs enable artists to raise funds in exchange for a portion of royalties to investors, fans, or record labels. This application of music NFTs has been the most successful in generating revenues for artists to date.

NFT Marketplace for Fans: Triblymusic.com, Oneof.com, Zora.co, Bitsong.io, Limewire.com, Fanaply.com

Invest in Music: Royal.io, Anotherblockchain.io, Vezt.co

Decentralized Digital Distribution Platforms

Decentralized digital distribution platforms have become the king and queens of the music industry. Spotify alone is projected to earn $100B in revenues in 10 years and heavily relies on major record labels for access to music rights. In addition, conflicts of interest may emerge with listener recommendations on platforms depending on advertising dollar spends and digital distribution platforms that sign artists directly. Web3 platforms are betting digital distribution platforms have misaligned incentives. As a result, decentralized digital distribution platforms allow artists, playlist curators, and listeners to own a piece of the platform, earn funds, and govern further developments. This realigns incentives to allow the most popular songs to emerge organically.

Digital Distribution Platforms: Audius.co, Tune.fm, Opus.audio, Musicoin.org

Decentralized Digital Distribution Aggregators: Onchainmusic.com

Music Creation and Remixing

NFTs allow artists to create complete songs and store the master file on-chain. This allows for easy royalties allocation and transport of the file between digital distribution platforms and owners. After gaining access through a smart contract, other artists can also access the file on-chain for easy remixing or use specific stems of songs while automatically attributing royalties to the original artists.

Generative Music: Soundmint.xyz, Mintsongs.com

Royalties Disbursement

Spotify and most other platforms pay artists through record labels. Artists receive funds within a quarter or a full year later. This is the case because of artist-label partnership arrangements. When artists are signed, they receive a loan from record labels to make their music, and that loan must be paid through royalties first to the record label before the artist starts to earn their part of the royalties. However, once this loan is paid back, there’s no reason for Spotify to be paying artists through record labels. Using crypto wallets, tokens, smart contracts, and music NFTs, artists receive payment for every play on a digital distribution platforms instantly. Many native blockchain music digital distribution platforms are building this functionality natively. There’s a massive opportunity for web2 digital distribution platforms to leverage the same functionality.

Royalty Disbursement: Digimarc.com, Mediachain.io (acquired by Spotify)

Music Rights Management

Music rights are extremely convoluted as several parties are involved. When someone requests music rights to a song for commercial use, they have to ask the artist and also the owners of the master file, usually the record labels. To gain the rights requires ‘pitching’ an artist and label, and you’ll be granted a wide range of rights types depending on the decision by all rights holders. The process is lengthy, manual, and requires several parties to decide, usually through email and meetings. Paying royalties to all these parties is also a nightmare. With NFTs, music rights are integrated directly into the on-chain master file and are auto-approved depending on various metrics or circumstances. NFTs also create a trail of how the music is used and where it’s being played and automatically attributes royalties back to the music rights owners.

License your Music: Dequency.io, Open-music.org, Myceliaformusic.org, Blokur.com

Tickets

NFTs replace music event tickets. NFTs enable fan recognition when fans purchase and enter an event. As a result artists can reward super fans who have purchased multiple tickets and attended various shows. In addition, ticket holders have more control over what they do with their tickets, allowing for easy transfer between owners. NFTs allow fans new experiences like watching exclusive or content online from artists.

NFT Tickets: Oveit.com, Defytickets.com

NFT Concerts: NFTconcerts.com

Creator DAOs

This post doesn't cover a big part of the native music NFT space. Check out @web3brett's post covering Creator DAOs here. This is a massive part of music NFTs that is decentralized and is creating a completely alternative music industry.

Part III - Analyzing VC Funding Activity in Blockchain Music Companies

Part II provided a summary of existing and possible applications of blockchain and NFTs based on the current state of the music industry described in Part I. Part III covers recent VC funding activity in blockchain music companies.

Themes

96 relevant company descriptions and industry tags highlight key areas blockchain music companies focus on: creators, fans, record labels, streaming, marketplaces, and royalties. The 96 companies were identified by querying Crunchbase and visualized using Tableau.

Funding

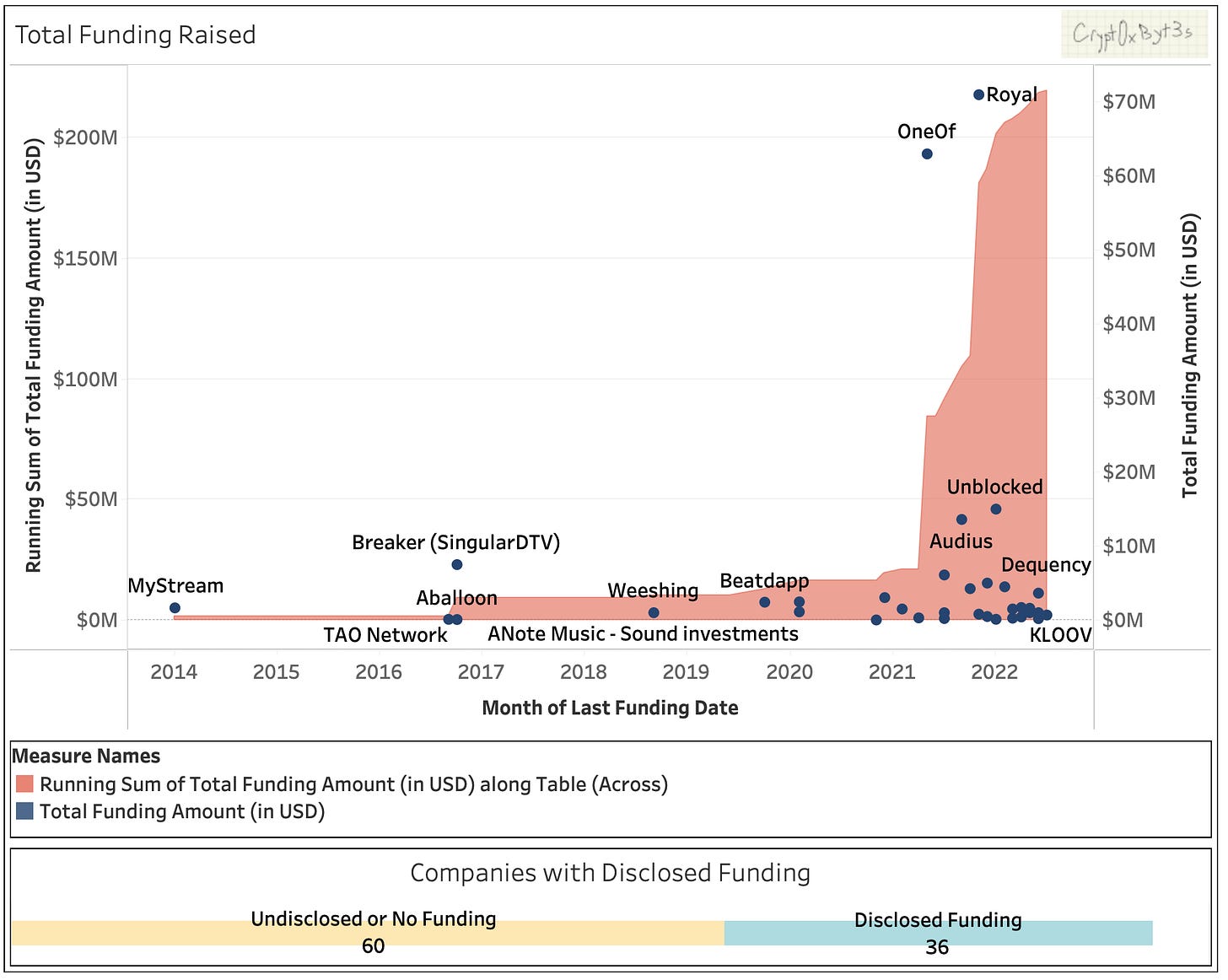

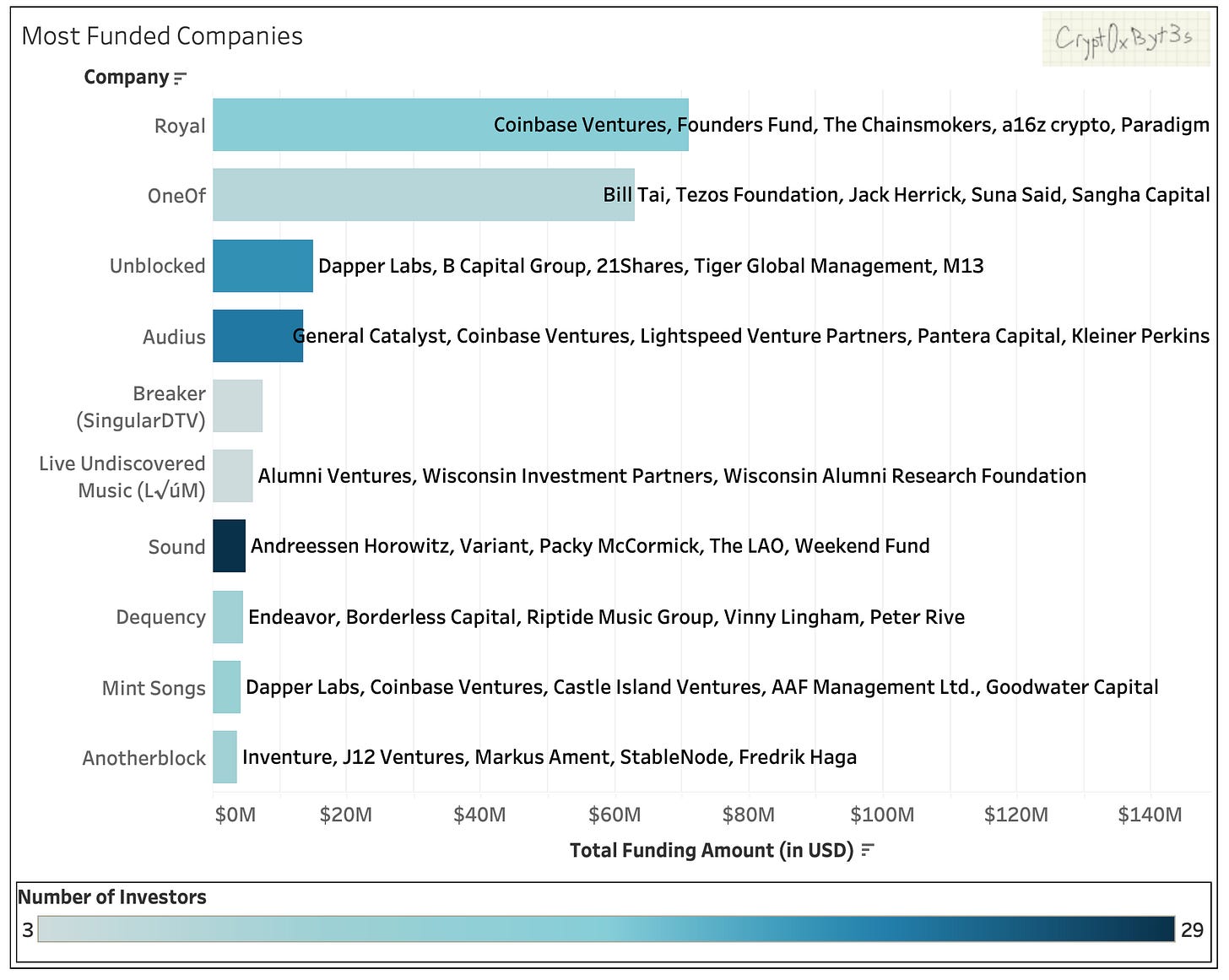

Blockchain music companies amassed at least $219M in disclosed VC funding. The majority of funding was received during 2021 and 2022, similar to the general blockchain market (see my post for more, VC Investments in Crypto Companies). The latest total funding grew 10x between 2020 and 2021 across 36 of the 96 identified blockchain music companies that disclosed funding.

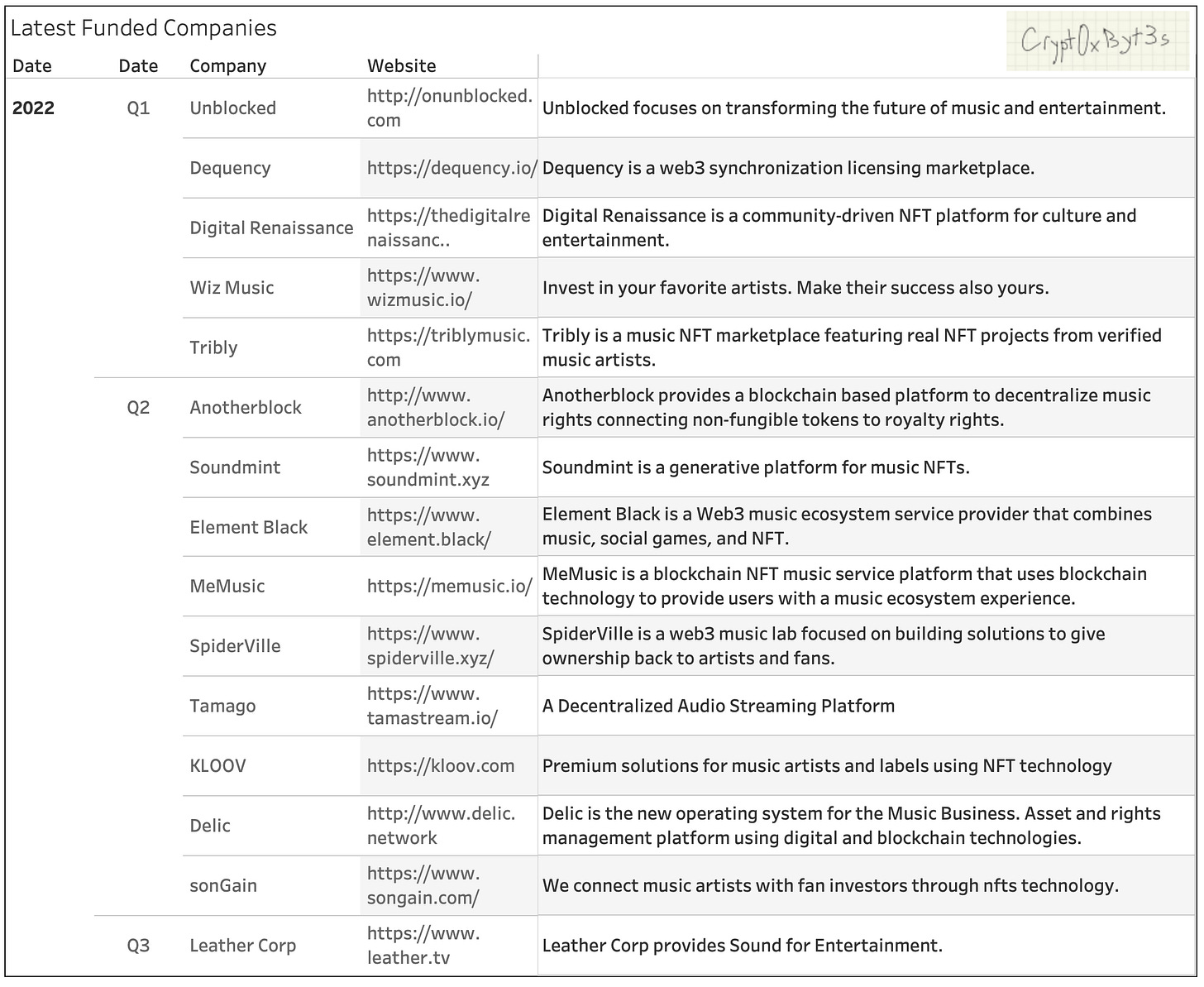

VCs invested in 24 blockchain music companies in Q2 2022, the most ever, surpassing the previous high of 21 in Q4 2021. Music is one of the fastest-growing categories receiving VC funding in crypto (see my post for more, The Usual Suspects - Identifying Investors in Crypto).

Maturity

Blockchain music startups are very nascent. The most mature companies have raised Series A rounds. The majority of funding is in the Seed and Series A stages. Twenty companies have raised $95M in funding in the Seed stage.

The most significant bets in the space for VCs are Royal (participate in royalties from web2 streams), OneOf (buy on-chain songs), Unblocked (builds NFT platforms for brands), and Audius (decentralized streaming). Prominent VCs and artist funds are top investors for leading companies in the space.

The latest funded companies focus on music rights management, generative music, serving artists entering the NFT space, and providing music rights to entertainment providers like Netflix.

Geography

Most VC-backed blockchain music companies with disclosed funding are based in the US, as are most blockchain companies (see my post for more, VC Investments in Crypto Companies).

Conclusion

A lot is changing in the music industry. An ongoing power shift between record labels, digital distributors, and artists continues to unfold. Blockchain-enabled tech like NFTs and decentralized platforms offer a new approach to expedite the freedom of creators while rewarding music fans, and redefines record labels and digital distribution platforms. Builders and investors realize the potential and have invested over $219M of disclosed VC funding within the last year. Although the Crunchbase dataset only identified 96 VC-backed companies, many more companies are operating as DAOs or are still under the radar. The space is still nascent but developing quickly. Not only can decentralized digital distribution platforms and NFTs better the experience for all parties involved, but it’s also creating new revenue streams through the fan and artist relationship that promise to grow the music industry. At its core blockchain technology turns each song into a unique, interoperable asset in the digital world and allows for many existing and new parties to participate in generating existing and new revenues.

Subscribe below to my free Substack to receive an email of my next post. If there are specific questions or recommendations please leave a comment or DM me on Twitter.