This post breaks down sophisticated investor participation and growth over time in crypto. It identifies the most active investors in crypto and companies with the most funding and backers. It also surfaces crypto categories gaining funding traction from sophisticated investors, including VC, PE, hedge funds, family offices, corporates, institutions, and HNWI investors. They will be referred to as simply investors in this post.

Summary

Investor interest in private crypto companies is healthy and ripe for growth as 2022 saw a significant uptick in new investors, companies funded, and new categories emerging. 9% of all crypto investors have invested in 5+ companies and are referred to as frequent investors vs. the rest, infrequent investors. Frequent investors are shareholders in most crypto companies, but this is changing. For the first time in 2022 Q1 unique infrequent investors outpaced frequent investors and grew quarterly deals by 3x. This is astounding, considering that infrequent investors make up 91% of all investors. The growth of infrequent investors is one of the strongest signals of growing investor interest in crypto. Companies raising from frequent investors raise on average 138% more money than companies raising from infrequent investors. The most active frequent investors in the space are Coinbase Ventures, DCG, Animoca Brands, a16z, Polychain, Blockchain Capital, Galaxy Digital, and Pantera. The most significant bets include Coinbase, Circle, Chainalysis, Forte, Dapper Labs, Alchemy, Paxos, Near Protocol, Sorare, Consensys, and BlockFi. Ecosystem & service firms and exchanges were the most popular categories to deploy funding into over the last year by the most frequent investors. Emerging categories across all investors include DAOs, music, institutional-related, computation, healthcare, metaverse, Algorand-related, education, and logistics.

Read below for a deep dive into the data. Raw data of 1,850 crypto companies were pulled from Crunchbase. Data analysis and visualizations were authored by Crypt0xByt3s.

Frequent vs. Infrequent Investors

As of June 30th, 2022, $90.7B in disclosed funding has been raised across 1,850 companies. Most deals are in the early stages, with a significant uptick in the seed stage in 2021 Q4 (more here, An Overview of VC Investments in Crypto)

Who is funding private crypto companies? Is it a limited number of investors, or are we at the stage where we’re seeing many unique investors participating?

There were a limited number of investors in crypto up until early 2021, when that drastically changed.

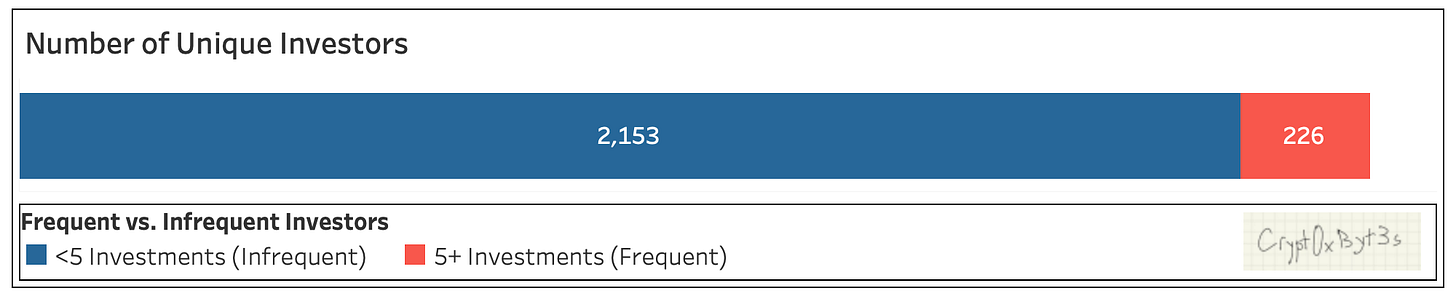

Since 2011 2,379 investors have participated in private crypto company deals. 9% (226) are frequent investors - those who have invested in over five crypto companies.

Despite only accounting for 9% of the investor population, the 226 frequent investors in aggregate have invested in only 25% fewer companies than the 2,153 frequent investors.

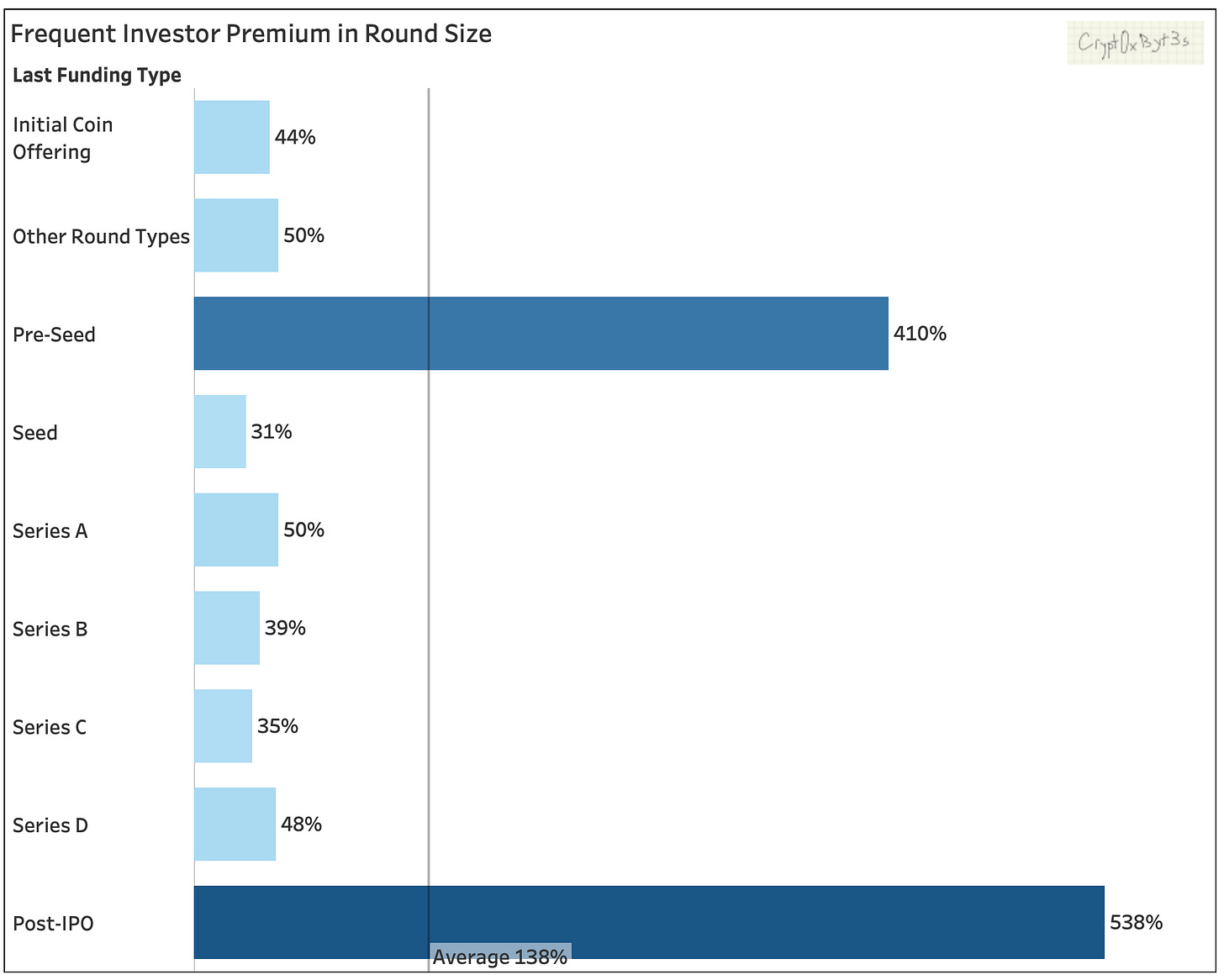

Frequent investor-funded companies raise more money at all stages than infrequent investor-funded companies. Perhaps frequent investors are willing to spend more given their belief in the crypto space. Or maybe the most sought-after companies are going to frequent investors to raise.

Now that we understand the dynamic between frequent and infrequent investors in the space let’s uncover the most frequent investors.

The Usual Suspects - The Most Frequent Investors in Crypto

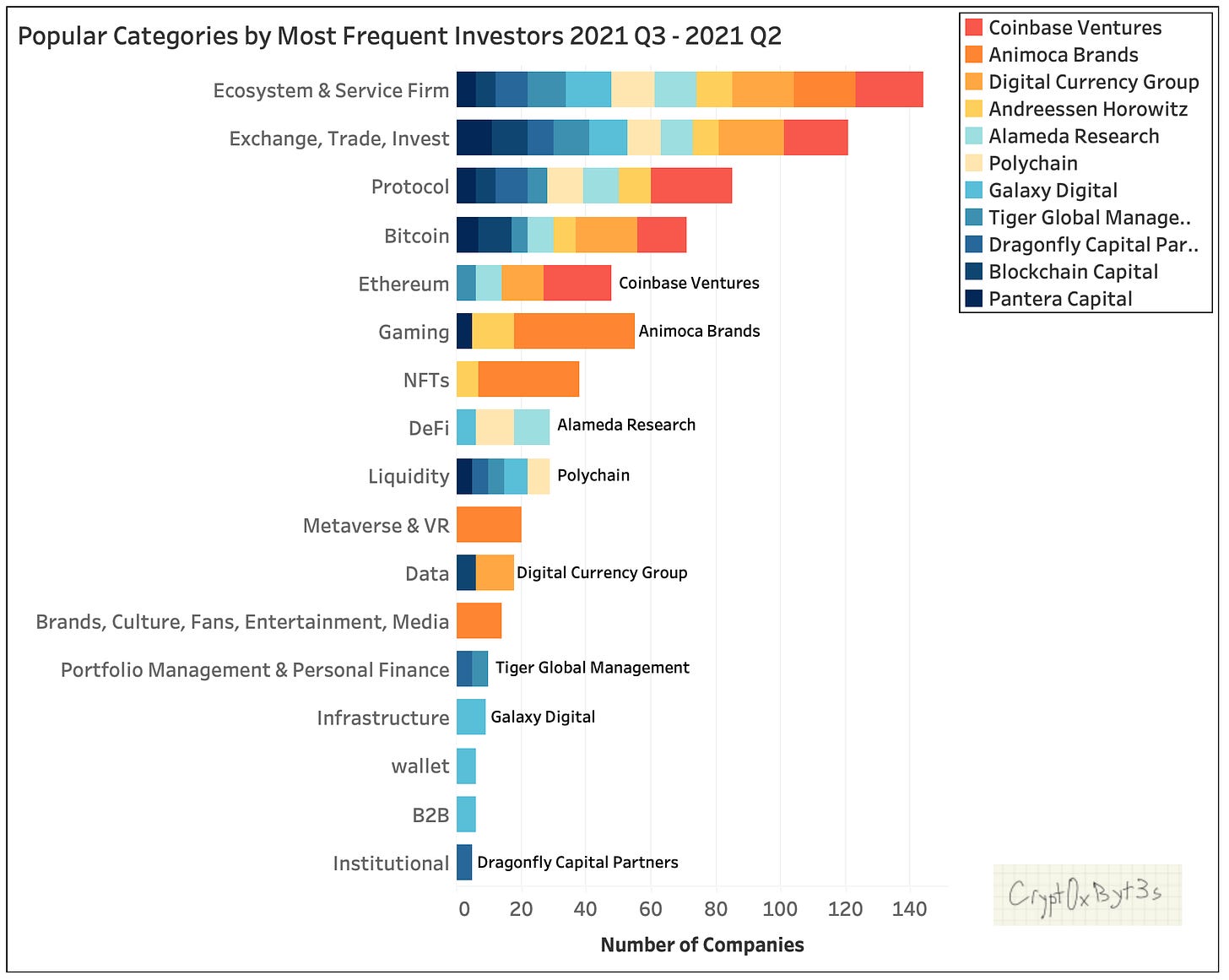

Four of the 226 frequent investors invested in 70-115 companies, six in 40-55 companies, twenty-five in 20-33 companies, and the rest in 5-19 companies. Coinbase Ventures, DCG, Animoca, a16z, Polychain, Blockchain Capital, Galaxy Digital, and Pantera are the most frequent crypto investors.

There has been an overlap of investor names across different funding ranges in the last year. However, each funding range has a unique top 5 most frequent investors. The most active VC quarters in the past year have been 2022 Q1 and Q2 for frequent investors. Overall, all signals point to frequent investors having more appetite for crypto investments despite the current climate.

Median Portfolio Company Round Size

Let’s look at the median number of rounds of funding frequent investor portfolio companies have. A relatively lower number indicates an investor is more comfortable investing earlier than their peers. Or perhaps investors with relatively high median select companies that go on to raise multiple rounds. Companies raising larger rounds most likely have more previous rounds.

Identifying Winners and Popular Categories of Most Frequent Investors

The twenty-five top-funded companies overlap across twenty-two investors, with most companies having participation from at least three investors within the most frequent investor list.

The top eleven most frequent investors have invested in similar popular categories as the general market. Certain investors are carving their niche categories within the most frequent investors. Animoca Brands, for one, is heavily leading investments in gaming, the metaverse, and NFTs. However, most investors seem agnostic across top categories.

Emerging Categories by Latest Funding Activity

Looking across the entire set of investors, the fastest-growing categories in terms of percentage growth of funding dollars include DAOs, music, institutional-related, computation, healthcare, and the metaverse. Healthcare, music, Algorand-related, education, and logistics companies are seeing the fastest growth in the percentage growth of number of companies being funded. If you’re interested in the all-time most funded categories, read An Overview of VC Investments in Crypto.

Conclusions

The number of investors deploying money into private crypto companies continues to increase, with a significant uptick in 2022. New categories continue to emerge in crypto, further highlighting that blockchain tech has the potential to impact many areas in the world. Investors are willing to deploy significant dollars into crypto category-leading companies, furthering investor confidence in the space. Investor interest in private crypto companies is healthy and ripe for growth as 2022 saw a significant uptick in new investors, companies funded, and new categories emerging.