Battle of the DEXs, Uniswap, or Curve?

AMM architecture is the backbone of DeFi DEX dApps. AMMs enable crypto users worldwide to swap tokens, earn passive income, and engage in arbitrage opportunities in real-time, 24/7. However, AMMs have risks for liquidity providers who take on impermanent loss (IL) and smart contract risks. On the other end, traders take on slippage risk. IL and slippage are inherent to the AMM model, and many DEXs have innovated on the AMM architecture to minimize IL and slippage impact. The latest iterations of Uniswap V3 and Curve V2 are leading examples of the most innovative AMM architectures around but come with their unique tradeoffs.

It’s important to note that Uniswap and Curve provide liquidity for pegged assets. Uniswap supports LP pools for non-pegged ERC20 pairs as well. Curve V2 has enabled non-pegged ERC20 pools, but only for select tokens such as ETH and WBTC; Curve’s primary value add remains low slippage pegged asset swaps.

Before going into how Uniswap and Curve AMM architecture compare, let’s first understand what kind of activity each DEX attracts.

Comparing Uniswap and Curve On-Chain Metrics

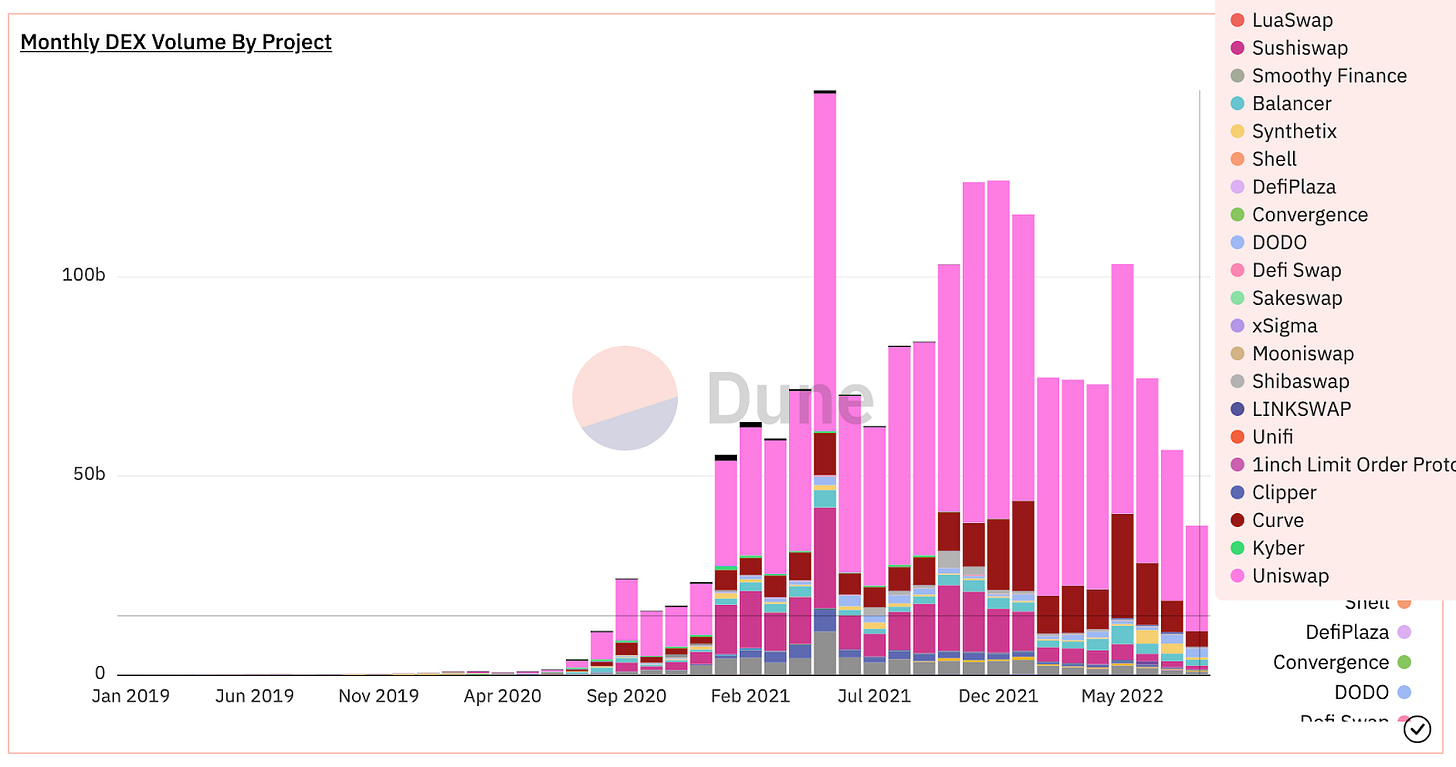

Uniswap dominates almost 70% of DEX volume today, which has been the case since 2020.

The last seven days showcase most Uniswap volume derives from non-pegged asset pools. The largest pool, WETH/USDC pair, accounts for $4B in volume in the previous seven days, and USDC/USDT accounts for almost $1B.

In contrast, the Curve non-pegged assets pool Tricrypto2, consisting of wBTC, ETH, and USDT, averages $77.7M daily USD volume, which is $543.9M volume per week, a minor contender to Uniswap.

A more apples-to-apples comparison is looking at USD stable swaps on Curve and Uniswap since most Curve pools cater to pegged asset swaps. Before May 2021, Curve dominated stable USD swaps. However, after lowering LP fees to 0.05% initially, thanks to the V3 upgrade and further enabling LP fees of 0.01% in November 2021, Uniswap now sees between 75%-90% of all stable swap volume most weeks as of May 2022.

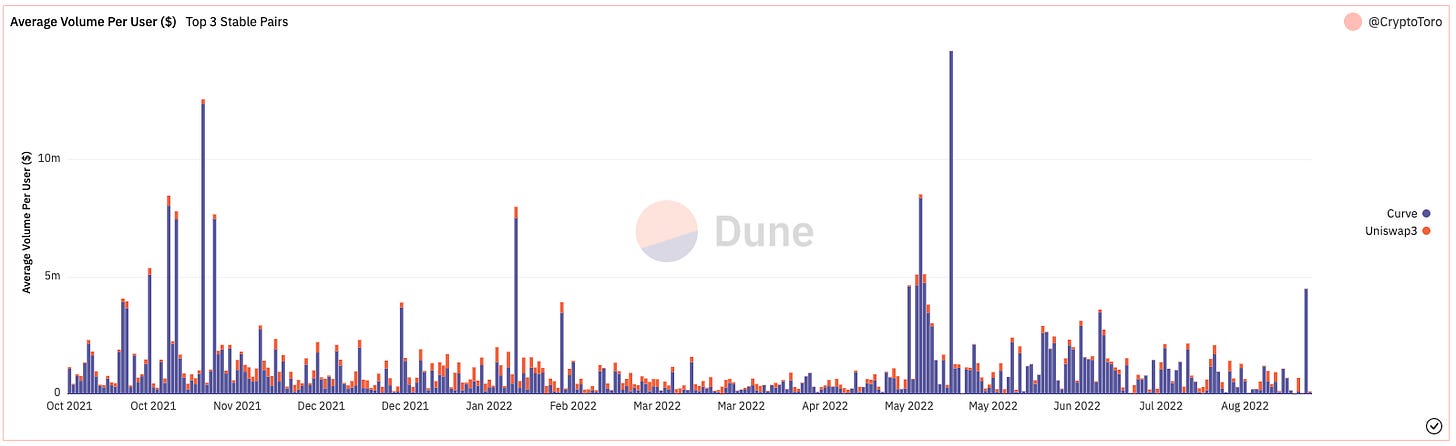

One significant on-chain metric highlights Curve’s low slippage advantage for large trades over Uniswap. If we look at the average volume traded per user, Curve dwarfs the average trade size of Uniswap.

Uniswap is said to have great UI and brand recognition relative to Curve. Google Trends agree when it comes to the brand recognition of Uniswap relative to Curve.

What does the data tell us about who uses Uniswap or Curve to execute a trade?

Traders looking to trade non-pegged ERC20 pairs use Uniswap. Traders looking to swap pegged assets also use Uniswap. In addition, Uniswap branding and UI attract more traders. Curve is preferred for larger pegged asset trades, most likely due to lower slippage advantages.

Considering the LP Perspective

Without LPs, there are no AMM pools for traders to swap tokens. So what makes an LP want to provide liquidity to Uniswap over Curve, or vice versa? First, let’s understand the current LP market share distribution and then dig into the AMM architecture to understand LP decision-making.

Comparing Uniswap and Curve On-chain TVL Data

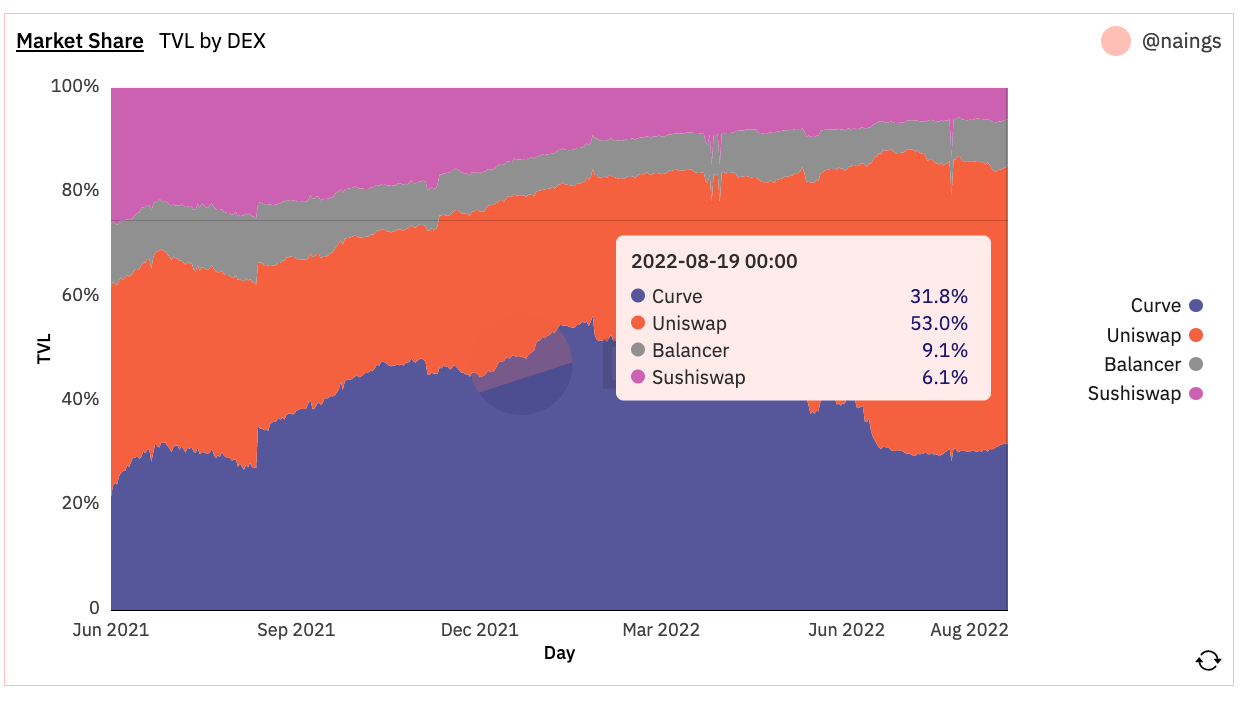

Uniswap dominates DEX TVL with 53% of the market share. This is expected since Uniswap also dominates the trading volume.

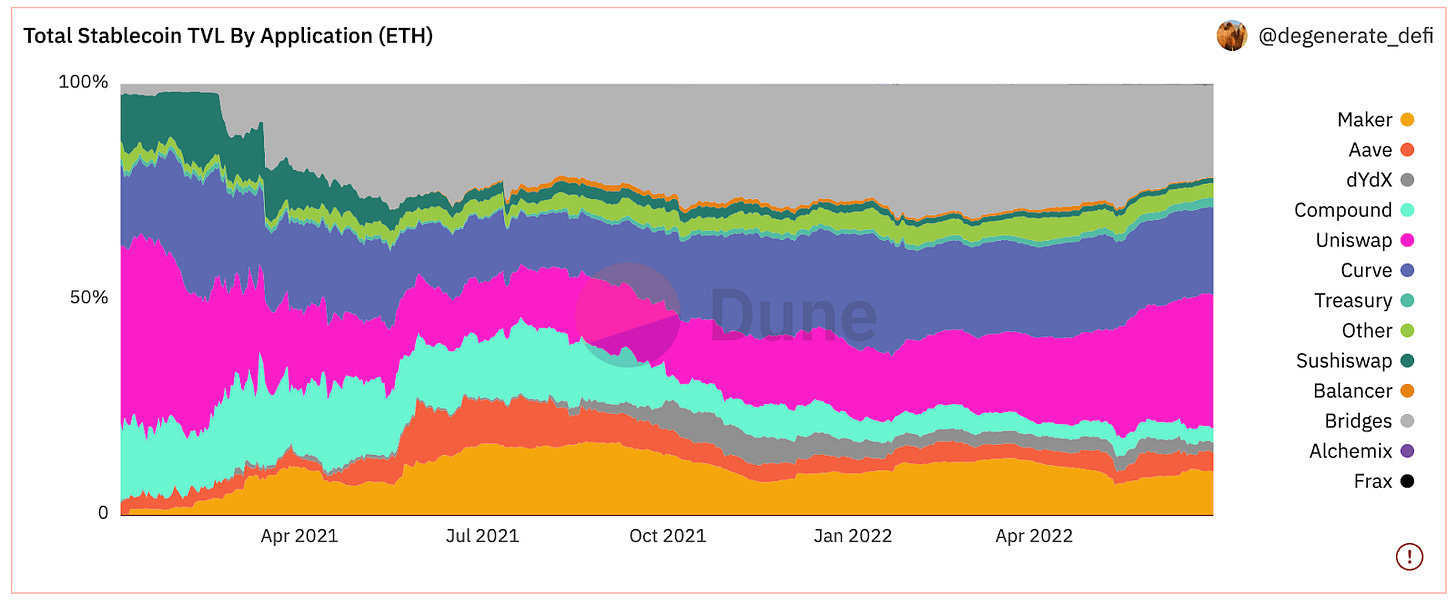

When comparing the TVL of stablecoins, Uniswap is still in the lead with a 31% market share. On the other hand, Curve is close with a 20% market share.

On-chain data further confirms both traders and LPs concentrate more on Uniswap.

Uniswap vs. Curve AMM Architecture Comparison

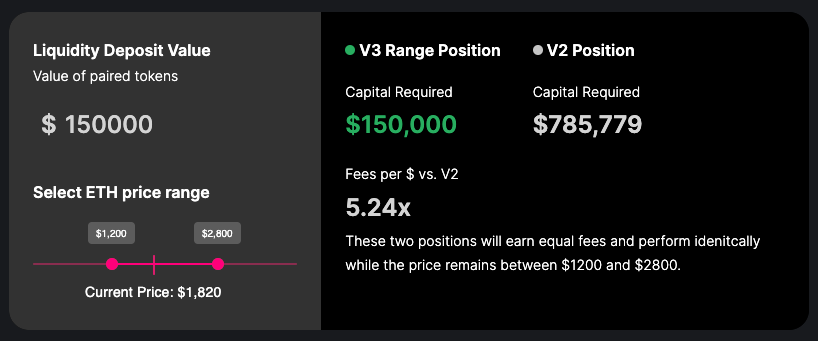

Uniswap V3 utilizes a CPMM approach to bonding curves and allows LPs to select price ranges. LPs can concentrate liquidity within any specific price range to earn more fees with less capital at risk. In Uniswap V3, an LP with $150k makes the same total fees as an LP with $785.8k in Uniswap V2, a traditional CPMM. Uniswap V3 tiers LP fees from 0.01% to 1% depending on asset volatility and price range selection relative to an AMM's current exchange rate.

Uniswap V3 enables active LP strategies such as fee-earning limit orders, profit-taking, buying the dip, primary issuance events, and arbitrage opportunities like Just in Time Attacks. All of these are possible since LPs can concentrate liquidity and take varied approaches to provide liquidity based on their view of asset prices. This type of AMM rewards active LPs. LPs looking for a more passive experience on Uniswap V3, protocols like arrakis.finance provide an automated liquidity management solution promising to optimize Uniswap V3 yield.

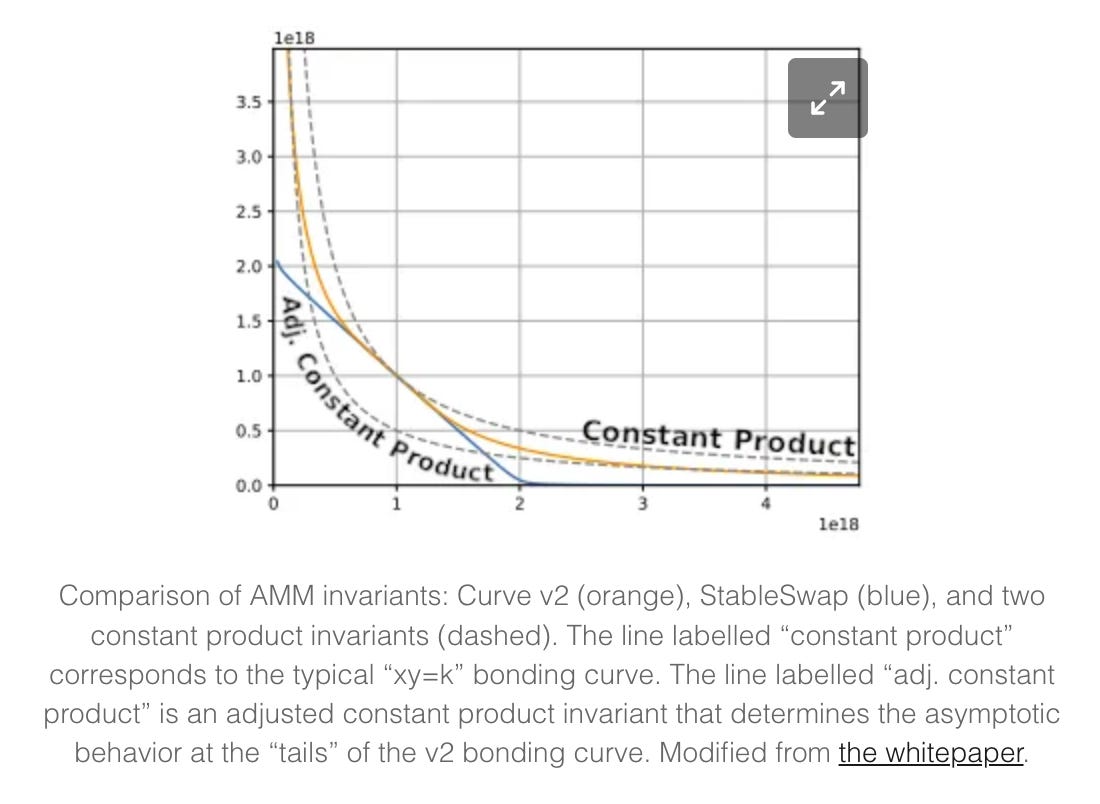

Now let’s consider the Curve approach to AMM architecture. Curve utilizes an intermediate bonding curve between CPMM (Uniswap) and CSMM (Curve V1) bonding curve that concentrates liquidity near the changing bonding curve's center. In addition, the bonding curve parameters determine how flat the center of the bonding Curve is. As a result, the flatter the center, the more liquidity concentrates near the exchange rate. As a result, Curve offers lower slippage trades of pegged assets even for larger swaps, thanks to its flat-centered bonding curve.

Curve allows pool operators to customize parameters of the Curve V2 bonding curve equation to accommodate volatility for non-pegged assets. As volatility increases beyond a flat center point, Curve V2 bonding curve begins to function as a CPMM bonding curve. Curve AMM architecture operates similarly to Uniswap V3 but removes the LP ability to select price ranges. Instead of allowing LPs to decide where to concentrate liquidity, curve AMM architecture automatically concentrates liquidity to price equilibrium using an internal price oracle and bonding curve re-peg mechanism and dynamically adjusts fees. It’s also noteworthy that Curve’s complex bonding curve formula can create additional risk in highly volatile times as the pool attempts to re-peg assets in a formulated approach rather than allowing an open market approach like Uniswap V3.

If the original peg is incorrect, arbitrageurs will take advantage (i.e., 3AC and Alameda dumping stETH and draining ETH in the ETH/stETH Curve Pool). The pool liquidity drained since the Curve bonding curve parameters initially pegged ETH/stETH incorrectly at 1:1. In this case, the stETH value should have been discounted due to its lock-up period instead of allowing arbitrageurs to gain 0.03 ETH per stETH deposited.

Curve LPs can also participate in pools used by lending protocols such as Compound and Aave and earn additional fees. There are also yield-optimizing pools like Yearn and Convex, which optimize yield for Curve LPs. LPs take a more passive approach and rely on Curve to concentrate LP liquidity to maximize fees earned and minimize IL.

How do LPs decide between providing liquidity for Uniswap or Curve?

LPs have to choose between active or passive investing. Uniswap V3 created many new strategies for LPs to pursue active opportunities and may require more activity than LPs in Uniswap V2. As a result, Uniswap V3 is likely to attract professional-type investors who are more comfortable being active investors. On the other hand, Curve optimizes for a passive LP experience with an automated approach to concentrating liquidity and attracts LPs looking to earn passive income with little work. It’s also noteworthy that Curve’s complex bonding curve formula can create additional risk in highly volatile times as the pool attempts to re-peg assets. Both strategies have merits, risks, and an ecosystem of protocols supporting other functionality. Thus far, LPs deposit more in Uniswap pools over Curve.

Tokenomics and Token Utility

Uniswap tokens function solely as governance tokens for now and are used to fund protocol development. Owning UNI allows holders to vote on the future of UNI development. UNI is purchased and earned through grants, bounties, or airdrops of early users. One issue with UNI holders is they lack any financial reward for providing governance. However, an upcoming fee switch on UNI could accrue added value to the UNI token by collecting 0.05% of 0.3% of swap fees. A fee switch could be a promising approach for Uniswap as swap and TVL volume continues to grow relative to other DEXs. However, such fee grabs by protocols are highly sensitive and require tactful timing as not to displease LPs and thoughtfully manage tokenomics to avoid future circularity, as with Curve tokenomics. In addition, Uniswap has to consider regulatory implications if it distributes fees earned to token holders.

Curve takes half the trading fees earned by LPs and splits earnings in half between CRV and veCRV token holders. LPs earn CRV providing liquidity, and can lock portions of their CRV token as veCRV and vote on future CRV reward distribution rates by pool. Curve’s approach to distributing rewards creates a circular reference as traders lock more CRV to have veCRV to vote to gain more CRV in their respective pool. In addition, veCRV and CRV can be locked in other protocols like Convex, which issues CVX, which then can be staked or locked up to vote in the Convex reward distribution rates. Convex is simply Curve tokenomics squared. Although this requires further analysis, Curve tokenomics encourages trades to earn CRV, to then lock up veCRV, to then earn more CRV, operating in a circular referencing cycle. In addition, as swap volume is moving away from Curve, LP fees decline, and Curve may rely on more inflationary approaches by rewarding LPs with more CRV. Note that Curve is also in the process of developing an overcollateralized stablecoin.

Future Outlook

Uniswap continues to innovate in its approach to the AMM architecture and, as a result, grew its market share significantly, servicing trades and growing TVL deposits. Traders and LPs are empowered to approach LP positions and trades with new strategies thanks to Uniswap V3. In addition, a thriving Uniswap ecosystem of protocols is developing, allowing LPs to provide liquidity passively, similar to Curve, and attract further volume. The upcoming UNI fee switch proposal also creates substantial revenues for token holders and strengthens incentives for all stakeholders. However, this is unlikely to pass any time soon due to regulatory concerns, which may label UNI as a securities token if token holders are entitled to collect revenue fees.

Although reducing slippage, the Curve AMM architecture is losing TVL and swap volume. It's dangerous in certain situations and is better suited for highly pegged fiat assets such as USDC. CRV tokenomics are of concern because they may not be enough to incentivize future LPs on Curve.

Over time, I suspect Curve market share will continue shrinking. Uniswap will fill the gap by providing low-slippage stable swaps with concentrated liquidity decided upon by the free market rather than a constrained formula.